Published: 13 Feb 2020

How the west invests in gold ETFs and how it is relevant to us?

As you would already know, gold is an excellent portfolio diversifier. It also acts an inflation and currency fluctuation hedge. ETFs of all kind are quite popular in the West and how they are investing in them can be of great relevance for us.

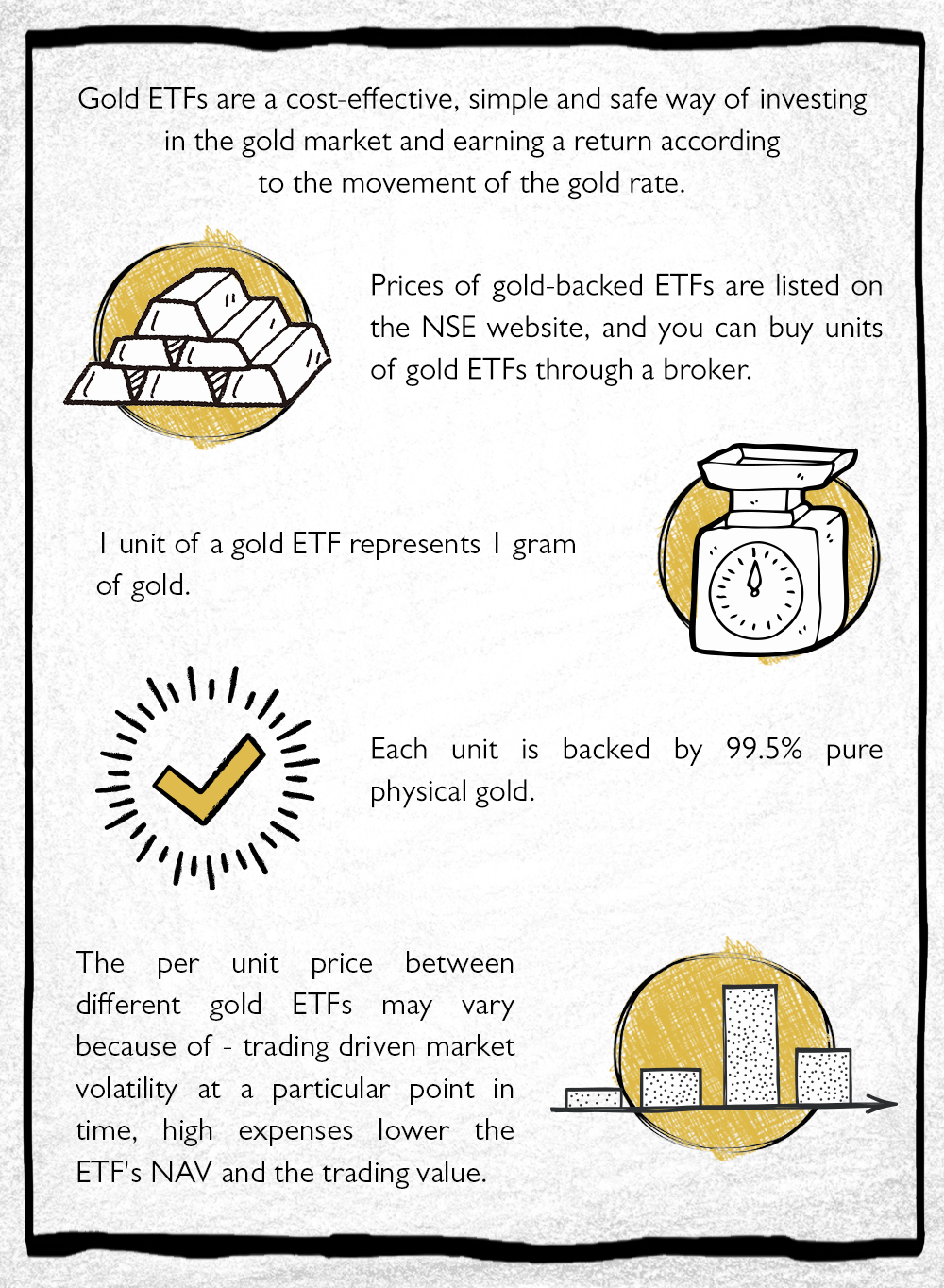

Units of gold-backed ETFs are traded in the exchange in the same way as an individual stock, and a gold ETF holds gold derivative contracts. While investing in a gold ETF, you don’t get to own any physical gold, nor do you get it physically upon selling it. Gold ETFs allow you to capture the growth of gold without worrying about storing it physically.

You are never short of reasons to buy gold, but while purchasing gold ETFs, you have to keep several things in mind.

Expense Ratio – ETFs are driven by an index, and in case of gold ETF, the growth of the fund is linked to the spot price of gold. This denotes that managing an ETF is a simpler affair as compared to direct trading, for example. Western ETF investors are advised not to pay extra charges on their ETF account for this particular reason. The rule of thumb is that no matter how much charge, often called “expense ratio”, you pay in a year, the ETF is going to ride on the gold spot rate only. So you might as well choose to pay lower expense ratio and continue to earn the growth that gold is enjoying.

Spread on Transactions – When you buy or sell ETF, you are charged a percentage, often very minimal, by the ETF fund managing company. However, it is charged on every ETF transaction that you make. Therefore, ETF investors generally tend to look for funds that charge lower spread or transaction charge on their ETF transactions. You need to make sure that while choosing a fund with a low expense ratio, the range of transactions is not very high. Otherwise, you will end up losing in your spread expenses whatever it is that you have saved in expense ratio.

Security Lending Fee – Security lending can be beneficial to the ETF holder if the earnings from the lending are passed on to him or her. It is a policy where other investors can borrow your ETF or portion thereof, in return for a fee to the ETF issuer. If the issuer passes on the fee to you, you end up earning on your ETF. Whether your ETF issuer passes on this benefit to you is something that you need to check before investing in a particular ETF.

Trading Volume – While selecting your gold ETF, you should check the trading volume of the ETFs that you had shortlisted. ETFs with low trading volume will have a bigger gap between the price quoted by seller and the price offered by the buyer. In other words, the ask/bid spread i.e. the difference between ask price and bid price will be higher. Therefore, going for the gold ETF that has a higher trading volume makes more sense.

Tracking Error – Compare the difference in the rate of appreciation between the gold spot rate and the appreciation of the ETF you are looking at. The difference is called tracking error. The lower the difference the higher the ETF investors had gained during the period in question.

Asset Under Management – As is true with any mutual and exchange-traded fund, compare the total asset under management or funds that these gold ETFs have. A robust fund is always a reassuring factor for the investor.

The convenience, safety and growth associated with gold ETFs make it a wise choice for any investor looking to diversify his or her portfolio or venturing out of the traditional gold investment route. By using these checkpoints and comparing the performance of gold ETFs available, you can pick the one best suited for you.