Published: 13 Feb 2020

What makes gold the most useful commodity for investment?

While investing in commodities is inevitable for most investors, here we take a look at how gold performs in comparison to other commodities both in the short and long run to help

-

Gold is a reliable store of value

From salt to tobacco to seashells, all kinds of soft agricultural commodities have been used as currencies at some point in history. But over time, the use of these soft commodities came to a halt for a variety of reasons:

- They were only grown in certain markets or geographies, making them hard to trade. For example, Tobacco was not grown in all parts of USA

- They could not retain value when moved from one region to another. For example, salt could not be used in parts of Africa where it rained. Even today, for example, oil production is geographically more concentrated in certain regions of the world; for example, more than 50% of proven reserves of oil are currently located in the Middle East.

- Using them as currencies would take them away from their primary use i.e. human consumption

After these soft commodities, metals began to be used as currency. Copper, iron and silver were in circulation across different parts of the world. However, these metals too fell short because of similar reasons:

- A metal like silver or copper, for example, has several industrial uses, so using it as a currency takes it away from its primary use

- aa

- All metals other than gold lose value over time because they tarnish or rust

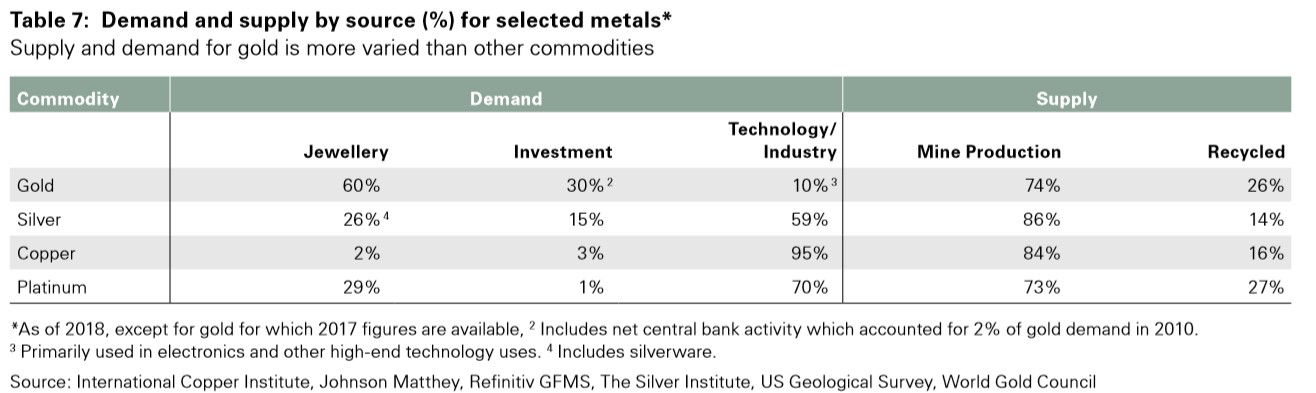

While gold too is superior by virtue of being a more malleable and ductile metal that is also a great conductor of electricity, it is too valuable, expensive and rare to be used industrially. Additionally, gold is chemically inert meaning it does not tarnish over time and retains its lustre and shine. Thus, because gold is almost indestructible, all the gold that has ever been mined still exists in one form or another. While other metals are unable to absorb shocks and shortages in primary production, recycled gold comprises a larger share of supply than for any other metal.

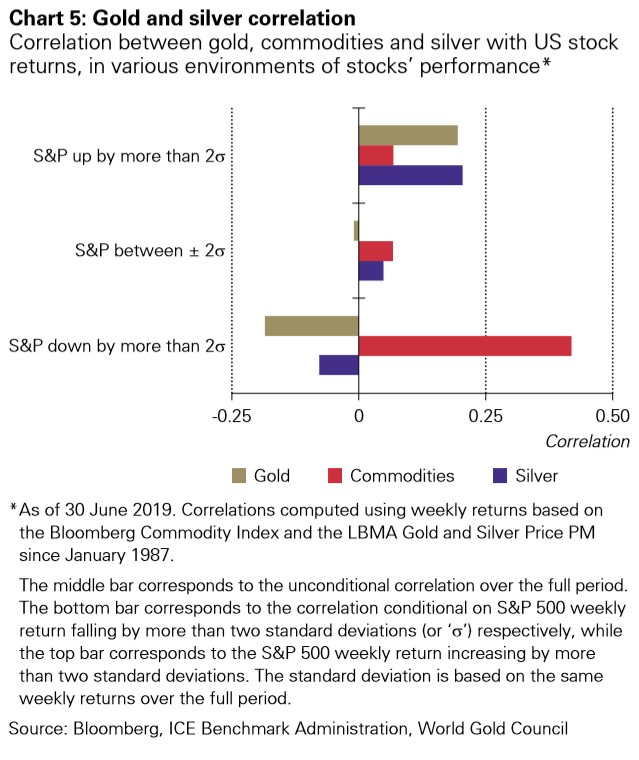

As a result, gold is also a much more effective portfolio diversifier than other precious metals like silver and platinum. When the market is doing well, gold and these other metals perform well, and their correlation is positive. But when the market takes a downward turn, the performance of metals like silver and platinum suffers because their demand depends largely on industrial demand.

Gold, with such few industrial uses, has no such issues, so its value persists even when the market is down.

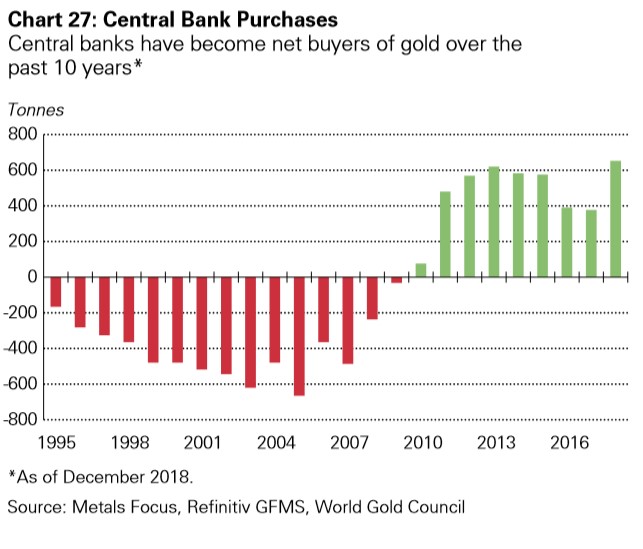

Due to these reasons, it made sense that gold played the role of a currency anchor till 1971, when the US, and the world, moved past the gold standard to paper money. But even today, gold continues to play a major role in determining a country’s wealth in the form of gold reserves, which are increasing year on year. In 2018 alone, central banks purchased more gold than at any time since the end of the gold standard – and that trend continued through the first half of 2019.

Over the long-term, currency and other assets may see periods of declining value. Gold, on the other hand, has maintained its value for ages. Since ancient times, gold has been used as a way to preserve and transfer wealth from one generation to another.

-

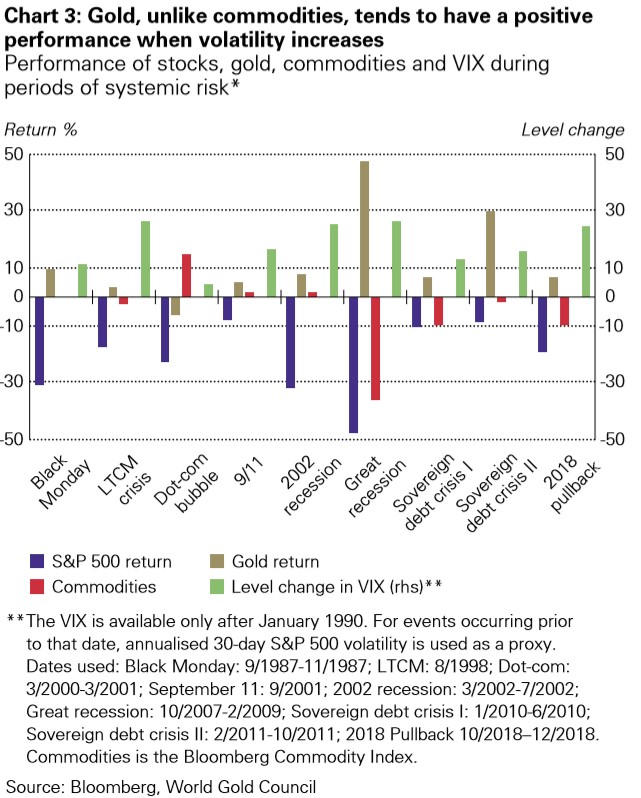

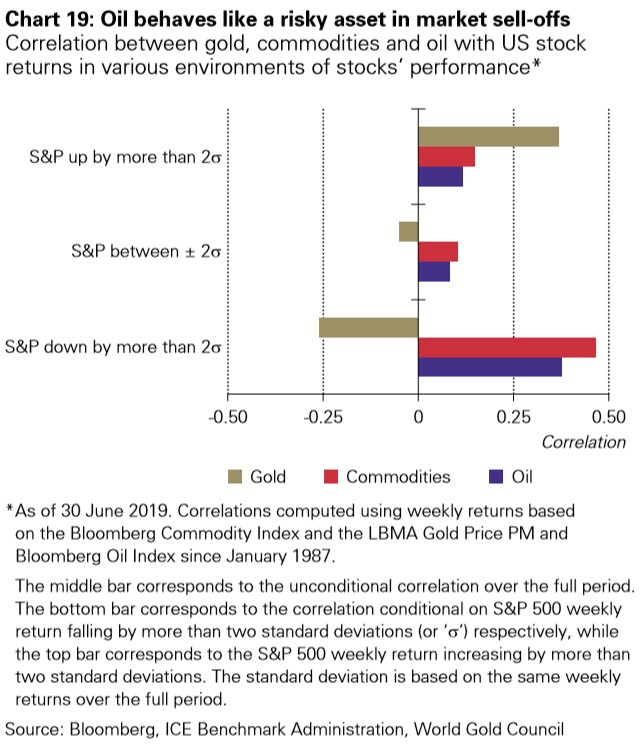

Diversification that counts, because gold is stable when other assets decline

The correlation between gold and other assets, including commodities, is dynamic i.e. gold behaves differently in correlation to other assets in different economic situations. Like other commodities, gold is positively correlated to stocks during periods of economic growth; when equity markets rise, so does the price of gold. But unlike commodities, gold also performs well during times of stress to the economy, including deflation, and any other events which can negatively impact wealth or capital. Gold is seen as a crisis commodity as it tends to hold its value even during geopolitical turmoil. For example, gold prices saw a major price movement this year in response to uncertainties around Brexit.

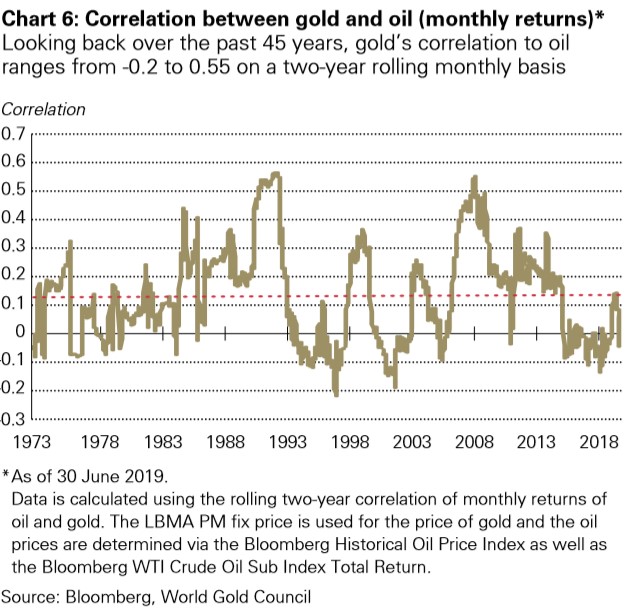

Gold and oil prices are not correlated, contrary to the popular belief- their performance sometimes moves in the same direction but at other times can be completely opposite.

Oil tends to behave as a risky asset while gold behaves as a risk-off asset.

-

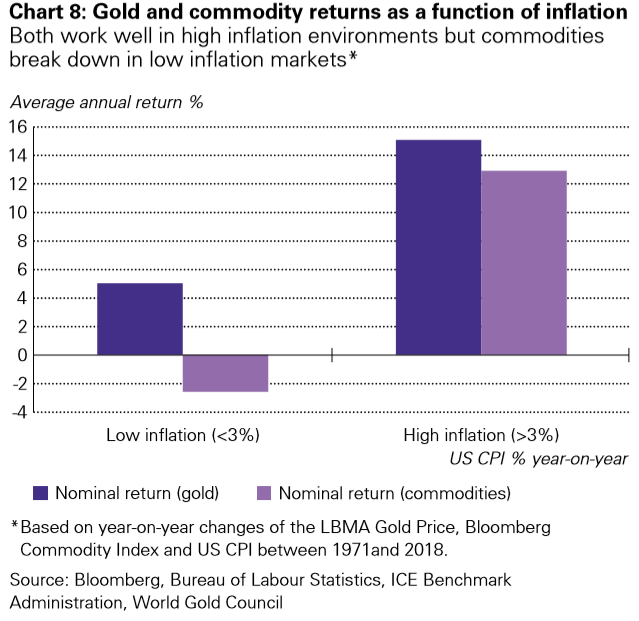

Gold as a hedge against inflation

One of the most common reasons for investing in portfolios is protection against the risk of inflation, a time when commodities perform much better than other assets. But, historically, specifically in the long run, gold outperforms them all.

Economist Vivek Kaul opines that inflation is a very real risk in the times we live in. “When a government prints a lot of money, you have a large amount of money chasing the same set of goods and services, which leads to very high inflation. So, the paper money that you hold tends to become worthless over a period of time, “says Kaul, quoting the example of Zimbabwe, where inflation is at 300% as of 2019, the highest in the world. To preserve one’s wealth in such situations of volatility, Kaul suggests dedicating 10-15% of one’s portfolio to gold, in any form. Watch the video on why should you invest in gold today.

-

Gold supply is limited, and demand is set to rise

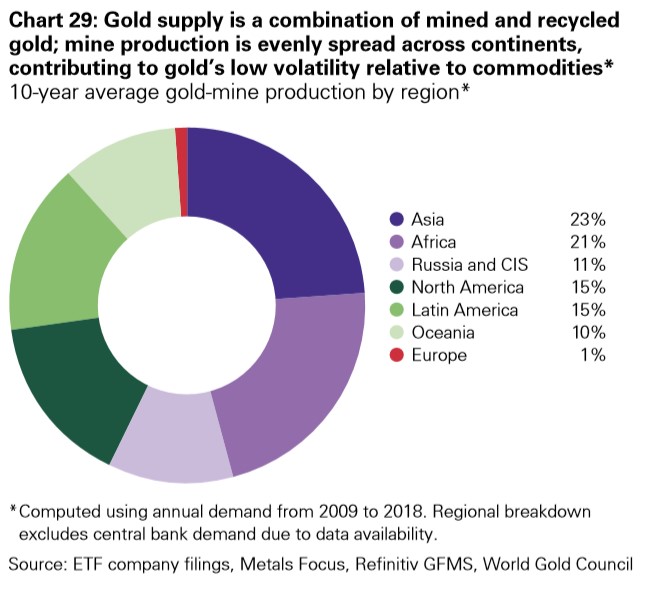

Gold is just the right amount of rare, which ensures its continuing appeal. But the market size of gold is large enough to make it a relevant investment for a wide variety of institutional investors, including central banks. Other commodities usually face supple issues in the short term due to variable production rates, but gold production is evenly distributed amongst different continents which avoid supply shocks.

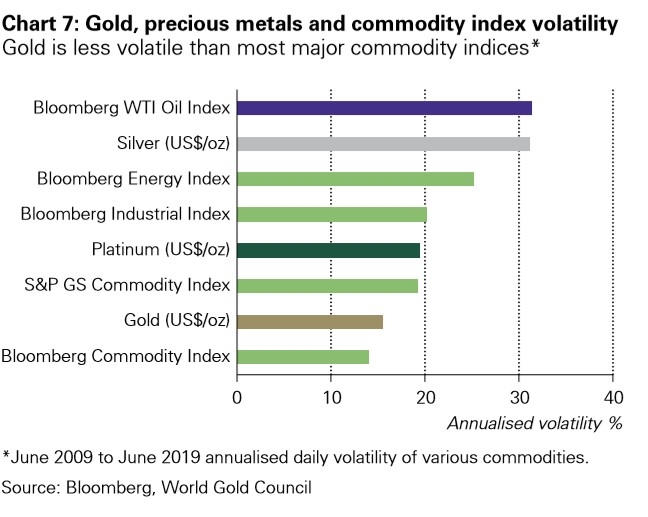

This helps to ensure that gold is much less volatile than other commodities.

The demand for gold is unshaken in a variety of economic situations. When the economy is doing well, people spend more on discretionary purchases such as jewellery and technological devices, which increases demand for gold. But even when the economy is down, when investors seek reliable, liquid assets to offset market losses, the demand for gold (and thus, its price) tends to increase.

One of the major opportunities for gold is the rapid increase in India’s middle class. The People Research on India’s Consumer Economy (PRICE) estimates that the middle class will increase from 19% of the overall Indian population in 2018 to 73% by 2048. Since gold demand increases by 1% with every 1% increase in income, it is no surprise that gold demand is set to increase.

While commodities other than gold undoubtedly have useful characteristics that make them important in portfolio diversification for both individual and institutional investors, gold has consistently outperformed these commodities due to its dynamic correlations to other commodities and assets that tend to make it a much safer investment for investors across risk profiles.